Stay Protected

Our Short-Term Plus Plans are designed to provide you with an extensive package of healthcare benefits. With this plan you have access to coverage that includes hospital, physician, and emergency services. Short-term plans are a great affordable option for healthy applicants with no preexisting conditions.

Short-Term Plus Plans EPO Application

PDF DownloadShort-Term Plus Bank Draft Form

PDF DownloadShort-Term Plus Plans Rate Sheet

PDF DownloadShort-Term Plus Plans Brochure

PDF DownloadCoverage When You Need It

Our Short-Term Plus Plans give you the coverage you need with the quality you expect. Whether you need temporary gap coverage or are looking for a lengthier plan, Cox HealthPlans has you covered. With this product, you have the option to select a policy term from 30 days up to 6 months. With the purchase of the reissue rider, the policy is guaranteed to reissue for one consecutive term of up to 6 months without regard to underwriting or completion of a health questionnaire. Short-Term Plus Plans work much like regular health insurance in that you pay a monthly premium, have a pre-set deductible amount, and co-insurance charges. These plans have no restrictions based on employment, open enrollment dates, or proof of a qualifying event that dictates your ability to obtain coverage.

Find a Provider

Having a great relationship with your doctor is important. All of our hospitals and clinics are staffed with outstanding physicians and specialists.

Prescription Plans

It's important to consider the number of prescriptions you and your family have when you are looking for a new health plan.

Is Short-Term Plus Right for You

Individuals & families looking for an affordable alternative to traditional insurance

Individuals & families who need coverage until the next Open Enrollment Period

Temporarily unemployed

Looking for COBRA alternative

Adult children losing coverage from a parent’s plan when they turn 26 years old

Recent graduates who do not have coverage under a parent’s plan

Employees without group health insurance coverage

Waiting for employer benefits to start

Short-Term Plus

This is only a brief summary of benefits, which is not intended to be comprehensive. Your Individual PPO Short-Term Plus Medical Expense Policy is the governing document for benefits information.

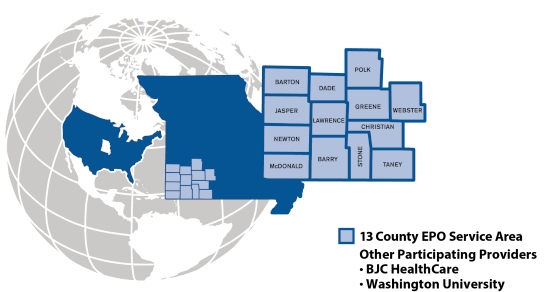

EPO Network

Exclusive Provider Organization (EPO) plans offer extensive health care inside the preferred CoxHealth network.

Secure Your Coverage

Single Pay - If you know how long you’ll need coverage and you have the ability to pay up front, the single payment option is your best solution. We accept single payments by check, cash, or bank draft.

Monthly Pay - You can choose the monthly payment option if you aren’t sure how long you'll need temporary medical coverage, or want the flexibility of spreading out your payments. We accept monthly payments by check, cash or bank draft.

Policy Term and Non-Renewability

Upon timely payment of premiums, this policy will remain in effect until the length of your policy term ends, subject to the terms of your policy. The policy term will begin at 12:01 a.m. Central Time, and will generally end on the last day of the billing period in which we receive your notice of termination. This policy cannot be renewed beyond the policy term, but you may re-apply for additional terms.

Free-Look Period

If you are not satisfied, you may cancel within 10 days after you receive coverage. All premiums paid will be refunded, minus the non-refundable application fee. This policy will then be void from its start as if no contract had been issued.

Coverage Effective Date

If coverage is approved, coverage becomes effective at 12:01 a.m. on the requested effective date, or the first day of the month following the date we receive your completed enrollment form, non-refundable application fee, and initial premium.

This coverage is not required to comply with certain federal market requirements for health insurance, principally those contained in the Affordable Care Act. Be sure to check your policy carefully to make sure you are aware of any exclusions or limitations regarding coverage of preexisting conditions or health benefits (such as hospitalization, emergency services, maternity care, preventive care, prescription drugs, and mental health and substance use disorder services). Your policy might also have lifetime and/or annual dollar limits on health benefits. If this coverage expires or you lose eligibility for this coverage, you might have to wait until an open enrollment period to get other health insurance coverage. This coverage is not minimum essential coverage.